Top 10 tips to pay off your mortgage sooner

Top 10 tips to pay off your mortgage sooner:

Canadian homeowners and real estate investors may not have a clear understanding how the Canadian mortgages work. All mortgages in Canada are compounded semi-annually. Mortgage penalties and administration costs are mostly misunderstood or not being explained to borrower of the mortgage.

[wpdevart_youtube]6la6CfpfeD8[/wpdevart_youtube]

Having a clear basic understanding of one of your largest financial obligations will assist to buy off the mortgage much faster, paying very minimum interest. An average Canadian will take approximately 25 years to pay off the mortgage.

Now that you have made your final investment decision, you may be left with a lengthy mortgage obligation after financing your purchase. However, there are many options to choose from to pay your mortgage earlier, or reduce the amount of interest you actually pay. Below are listed some mortgage tips:

1. Make larger payments to your principal each month: This is the most direct way to shorten your payment schedule. If it feasible to make larger payments, you will reduce the amount paid on interest overall. Keep note however, that you will usually be unable to reduce the amount of your payments until the end of the term, pending your mortgage agreement.

1. Make larger payments to your principal each month: This is the most direct way to shorten your payment schedule. If it feasible to make larger payments, you will reduce the amount paid on interest overall. Keep note however, that you will usually be unable to reduce the amount of your payments until the end of the term, pending your mortgage agreement.

2. Make accelerated biweekly payments instead of monthly: Making shorter, more frequent payments can take as much as a few years off your mortgage. The reason is because of the savings in acquired interest, as the accelerated payments equate to one extra monthly payment annually.

2. Make accelerated biweekly payments instead of monthly: Making shorter, more frequent payments can take as much as a few years off your mortgage. The reason is because of the savings in acquired interest, as the accelerated payments equate to one extra monthly payment annually.

3. Refinance with a shorter term mortgage: With lower interest rates, it is possible to refinance your mortgage with a shorter term loan while still being able to keep monthly payments close to what they originally were. Although you may be able to reduce the amount of your payments, by keeping the figure the same, you can actually pay off your loan sooner.

3. Refinance with a shorter term mortgage: With lower interest rates, it is possible to refinance your mortgage with a shorter term loan while still being able to keep monthly payments close to what they originally were. Although you may be able to reduce the amount of your payments, by keeping the figure the same, you can actually pay off your loan sooner.

4. Round up your mortgage payments: This is a simple tactic to ensure more funds are being put toward your mortgage, which you may have the option of doing in your mortgage agreement. However, make sure that any additional amounts paid go toward your principal.

4. Round up your mortgage payments: This is a simple tactic to ensure more funds are being put toward your mortgage, which you may have the option of doing in your mortgage agreement. However, make sure that any additional amounts paid go toward your principal.

5. Put any monetary birthday gifts towards your principal: The best gift anyone can give is financial freedom, so put any money given to you as a gift towards just that.

5. Put any monetary birthday gifts towards your principal: The best gift anyone can give is financial freedom, so put any money given to you as a gift towards just that.

6. Double up on monthly payments a few times a year: Whenever you have less expenses or obligations throughout the year, put any additional savings left over towards your principal. This is a great strategy to use if increasing your monthly payment is not feasible for you. You mortgage agreement may allow you to make prepaid lump sums.

6. Double up on monthly payments a few times a year: Whenever you have less expenses or obligations throughout the year, put any additional savings left over towards your principal. This is a great strategy to use if increasing your monthly payment is not feasible for you. You mortgage agreement may allow you to make prepaid lump sums.

7. Apply any tax refunds towards your principal: Again, this is another great use for any extra funds coming your way.

7. Apply any tax refunds towards your principal: Again, this is another great use for any extra funds coming your way.

8. Put any earnings or principal payments from bonds/stocks towards your mortgage payments: Investing in bonds is a great way to earn a regularly occurring source of income, which can be used towards your principal.

8. Put any earnings or principal payments from bonds/stocks towards your mortgage payments: Investing in bonds is a great way to earn a regularly occurring source of income, which can be used towards your principal.

9. Use your annual bonus towards your principal: Although it may not be easy making the trade-off between a well earned vacation, for example, and making a dent into your mortgage, doing so could make the difference in shedding years off your payment schedule.

9. Use your annual bonus towards your principal: Although it may not be easy making the trade-off between a well earned vacation, for example, and making a dent into your mortgage, doing so could make the difference in shedding years off your payment schedule.

10. Reduce the amortization period: As you renew your mortgage every few years, ensure that you are also reducing the amortization period. For example, when first acquired your mortgage for a period of 5 years, the amortization period was 25. If you’re renewing it after 5 years, make sure you reduce the amortization period to 20 years.

10. Reduce the amortization period: As you renew your mortgage every few years, ensure that you are also reducing the amortization period. For example, when first acquired your mortgage for a period of 5 years, the amortization period was 25. If you’re renewing it after 5 years, make sure you reduce the amortization period to 20 years.

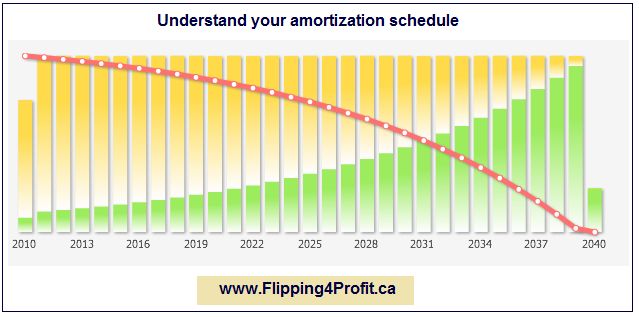

11. Understand your amortization schedule: On your amortization schedule, the payments will tell you how much you are paying toward your principal and interest. In the early stages, almost 98% of the payment goes towards interest payments, with very little going to the principal. Its advisable that you make larger payments to pay off the principal.

11. Understand your amortization schedule: On your amortization schedule, the payments will tell you how much you are paying toward your principal and interest. In the early stages, almost 98% of the payment goes towards interest payments, with very little going to the principal. Its advisable that you make larger payments to pay off the principal.

We can HELP !! We also BUY HOUSES. Please call:

P.S. Success isn't a matter of chance, it's a matter of choice. So it's up to you to make the right choice to become successful. If you don't know what to do it starts with making the choice to register for this LIVE real estate investors training in your town now and making sure you make the right choice to SHOW UP!!! Learn more to earn more!

Are you a Canadian real estate Investor? Join Canada's largest real estate investors club now.