- Nav Sing

- Mar 2, 2016

- Creative Financing

What is a Mortgage Investment Corporation (MIC) in Canada?

A mortgage investment corporation (MIC) in Canada as it is often referred to by, is a company given special designation by Revenue Canada, highlighted in Section 130.1 of the Income Tax Act. It is a corporation set up to enable investors to invest in a pool of mortgages, mostly residential properties. Canadian professional real estate investors intend to use them more frequently as well as general public through informed Canadian mortgage brokers.

The Canadian market needs another kind of lender. So mortgage investment corporations were created to address this demand. Mortgage investment corporation (MIC) in Canada specialize in giving short term loans, bridge loans, and mortgages to entrepreneurs or anyone else who can’t get a loan with a major bank. And due to the higher risk profile of these borrowers, they can be charged a higher interest rate.

The Canadian market needs another kind of lender. So mortgage investment corporations were created to address this demand. Mortgage investment corporation (MIC) in Canada specialize in giving short term loans, bridge loans, and mortgages to entrepreneurs or anyone else who can’t get a loan with a major bank. And due to the higher risk profile of these borrowers, they can be charged a higher interest rate.

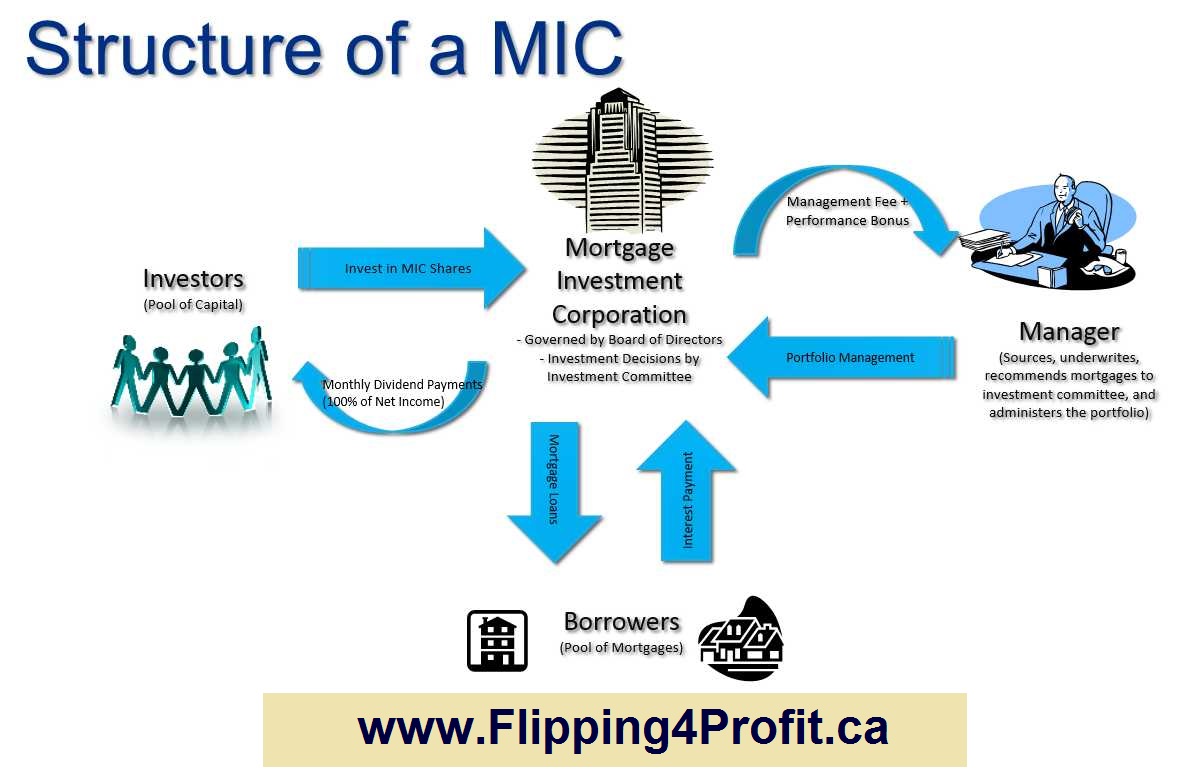

The structure of a mortgage investment corporation (MIC) in Canada is similar to a mutual fund; the main difference being that instead of investing the capital in stocks, bonds or other instruments, the capital in question is invested in a large pool of mortgages inherently reducing the risk through diversification.

The structure of a mortgage investment corporation (MIC) in Canada is similar to a mutual fund; the main difference being that instead of investing the capital in stocks, bonds or other instruments, the capital in question is invested in a large pool of mortgages inherently reducing the risk through diversification.

A mortgage investment corporation (MIC) in Canada is a flow-through investment vehicle which means that all revenues generated can be redistributed to investors without accruing any income tax. The mortgage investment corporation (MIC) in Canada itself is therefore not taxed as a corporation.

A mortgage investment corporation (MIC) in Canada offers investors with limited amounts of capital the opportunity to invest in a well diversified, high yielding, secure portfolio. Mortgage investments have long be a proven investment vehicle that has offered investors great and secure returns..

The principal characteristics of a mortgage investment corporation (MIC) in Canada, according to Section 130.1 of the Income Tax Act, are as follows:

- A mortgage investment corporation (MIC) in Canada must have at least 20 shareholders, and more than 40 investors not deemed "Accredited Investors".

- A mortgage investment corporation (MIC) in Canada is widely held, a shareholder may not hold more than 25% of the MIC's total capital.

- A mortgage investment corporation (MIC) in Canada must invest at least 50% of its capital in residential mortgages and/or CDIC insured instruments.

- A mortgage investment corporation (MIC) in Canada may invest up to 25% of its available capital directly in real estate property for income purposes but is restricted from developing land or engaging in construction.

- A mortgage investment corporation (MIC) in Canada is a flow-through investment vehicle and distributes all of its net income to its investors.

- All mortgage investment corporation (MIC) in Canada investments must be in Canada.

- A mortgage investment corporation (MIC) in Canada is a tax exempt corporation.

- Dividends received by mortgage investment corporation (MIC) in Canada shareholders that have invested in cash (outside RRSP) are taxed as interest in the shareholders hand.

- Mortgage investment corporation (MIC) in Canada Investments is eligible for all registered pension plans in Canada, such as RRSP's and RRIF's.

We can HELP !! We also BUY HOUSES. Please call:

P.S. Success isn't a matter of chance, it's a matter of choice. So it's up to you to make the right choice to become successful. If you don't know what to do it starts with making the choice to register for this LIVE real estate investors training in your town now and making sure you make the right choice to SHOW UP!!! Learn more to earn more!

Are you a Canadian real estate Investor? Join Canada's largest real estate investors club now.